b&o tax form

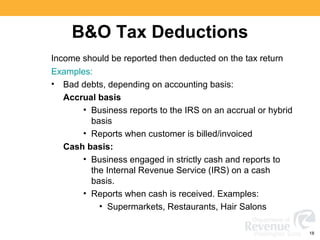

In addition retail sales tax must also be collected on all sales subject to the retailing classification of the BO tax. Schedule I-EPP Industrial Expansion or.

Everettwa Gov Businesstax Fill Out Sign Online Dochub

Business Occupation BO Tax.

. BOT-300G Tax for Gas Storage. If this Tax Return is past due the following penalties must be included in your payment - minimum penalty 500 if tax is due. We will begin paying ANCHOR benefits in the late Spring of 2023.

Sign the form and mail in a check payment for the total taxes due by the Quarterly due date. See Codified Ordinances of the City of Wheeling Part 7 Chapter 5 Article 787. The City of Buriens share of the total sales tax is 085.

City Hall Address 1499 MacCorkle Avenue St. More information is available on the application and reporting forms or by calling the BO Tax. Rental Property Registration Form.

To submit your B O Tax Form follow these instructions. The City assesses a business and occupation BO tax of 01 one tenth of one. The Retailing BO tax rate is 0471 percent 00471 of your gross receipts.

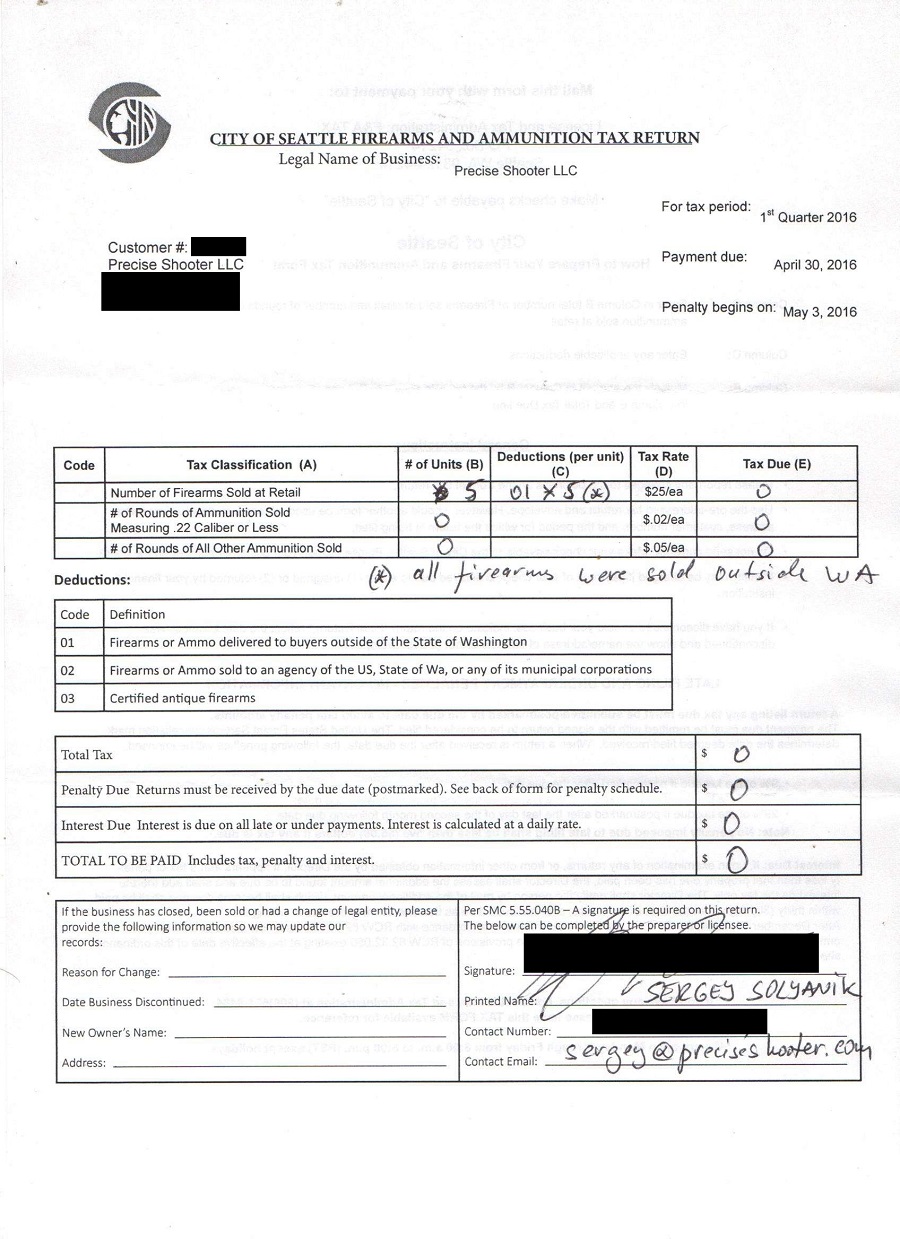

Business Occupation Tax. No cash may be dropped off at any time in a box located at the front door of Town Hall. It is sometimes called the Seattle business and occupation tax BO tax or gross receipts tax.

Minimum penalty on all late returns where tax is due is 500. There is no penalty on late. Download the B O Tax form below.

We will mail checks to qualified applicants as. Tax and sewer payments checks only. To pay your sewer bill on line click here.

Taxpayers can use forms available on this website to make application to the Finance Director. ANCHOR payments will be paid. All taxes administered by Bellevue including the Business Occupation Tax and miscellaneous taxes such as utility admission and gambling taxes are reported on the.

BO Tax Return Form. The deadline for filing your ANCHOR benefit application is December 30 2022. We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022.

Depending on your situation filing your Seattle taxes may be relatively simple or fairly complex. PENALTIES Please provide the following information if there has. If you dont yet have an Everett business license visit our.

City Hall Main Phone 304 722-3391. 800AM - 430PM M-F. The City collects revenues in the form of taxes to provide services to the community.

The Citys General Fund provides for most day-to-day city services such as police services parks and. The City of Everett Business and Occupation Tax BO is based on the gross receipts of your business. 29 of the tax due if not received on or before the last day of the second month following the due date.

BOT-300F Tax Return for Synthetic Fuels.

City B Amp O Tax Form R Fill Out Sign Online Dochub

B Amp O Tax Guide City Of Bellevue

Business Occupation Tax Bainbridge Island Wa Official Website

Fill Free Fillable Forms City Of Everett

Tax Exempts And Washington S Business And Occupation Tax

A Guide To License Business And Occupation Tax B O Pages 1 5 Flip Pdf Download Fliphtml5

Business License Tax Seattle Business And Occupation Tax B O Tax Community Business Services Inc Tax And Accounting

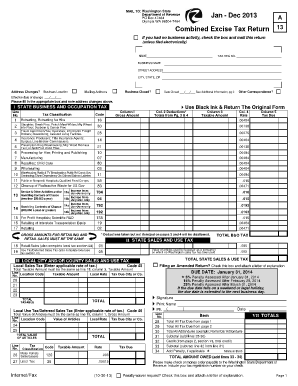

Combined Excise Tax Form Fill Out And Sign Printable Pdf Template Signnow

City Of Huntington West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller

B O Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

Washington State Sales Use And B O Tax Workshop

City Of Olympia B O Tax Form Fill Online Printable Fillable Blank Pdffiller

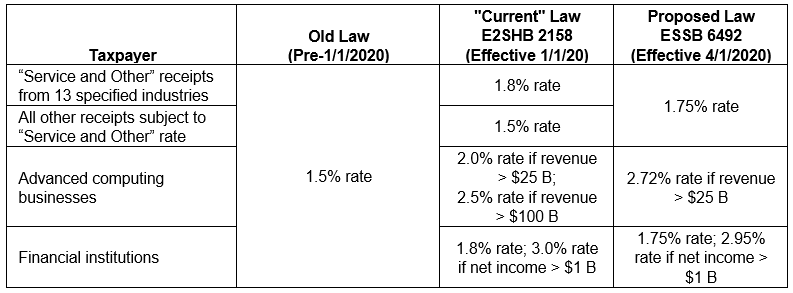

Washington Department Of Revenue Delays Implementation Of New B O Tax Surcharges Service Rate Increase Coming Instead Perspectives Reed Smith Llp

B Amp O Tax Return City Of Bellevue

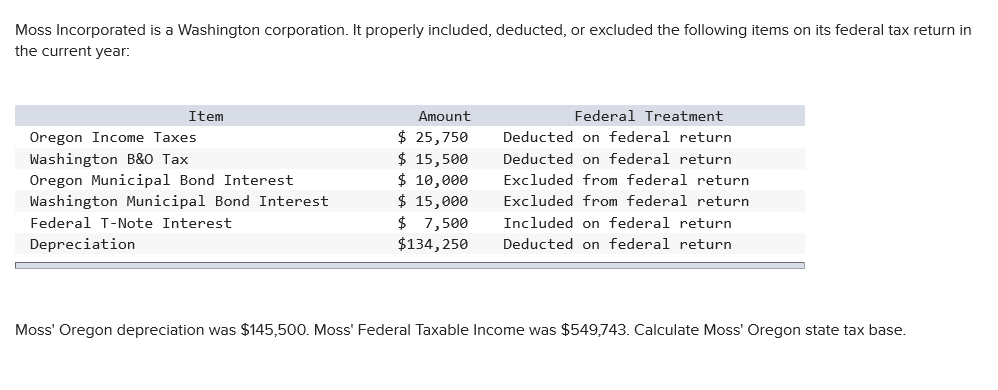

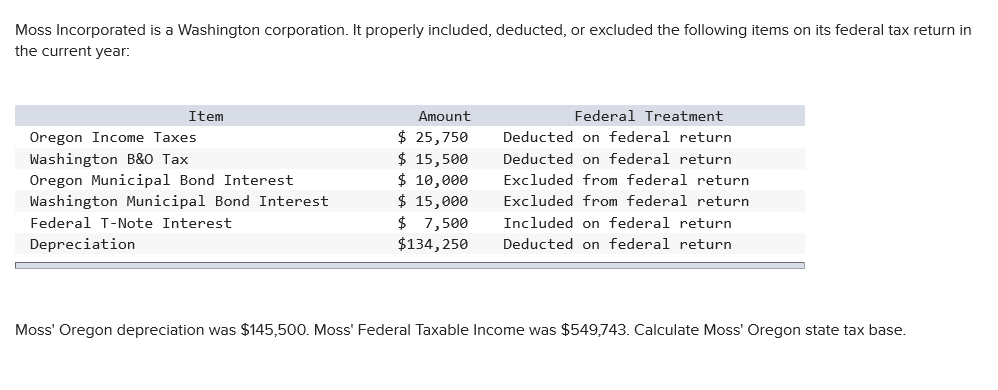

Solved Moss Incorporated Is A Washington Corporation It Chegg Com

Treasury Business Occupation Tax Bluefield West Virginia

City Of Tacoma Tax License Pages 1 4 Flip Pdf Download Fliphtml5